IVRM Services

Portfolio Analysis

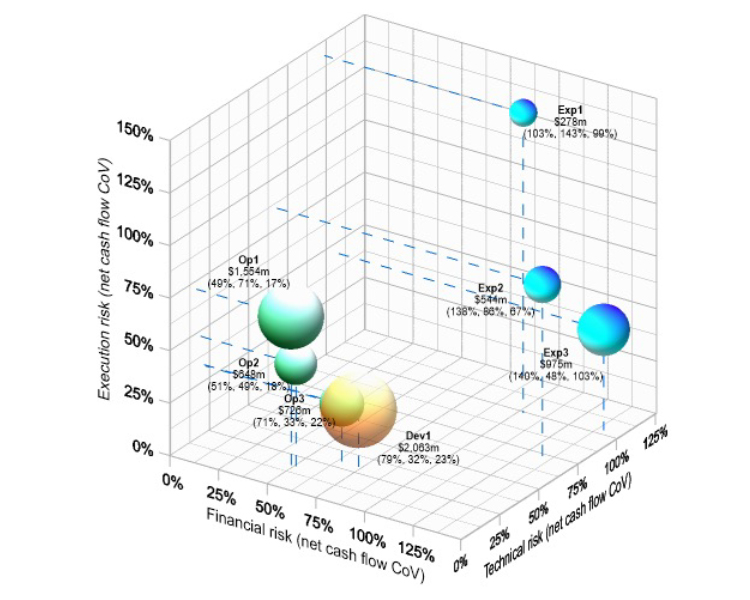

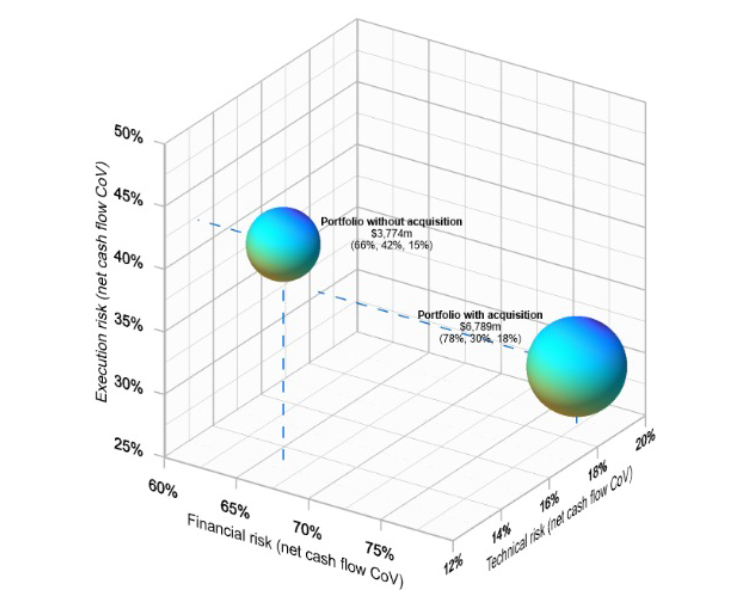

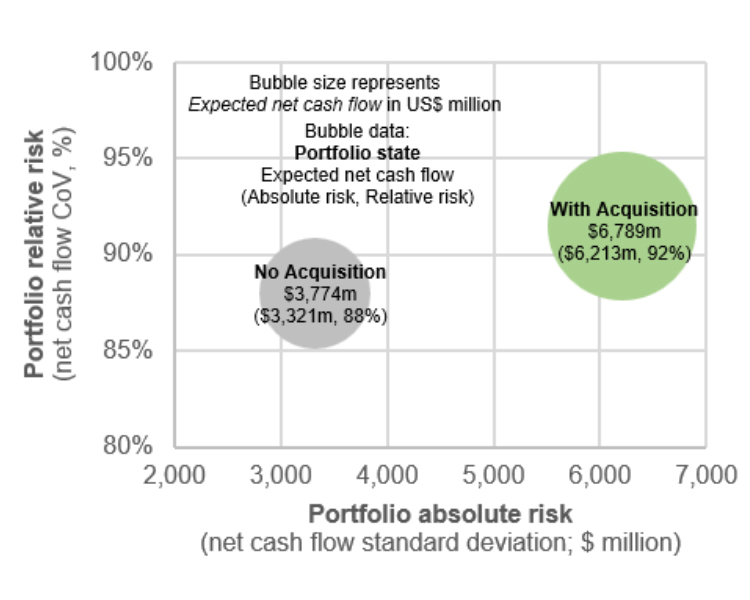

Mining project portfolios combine projects at various stages of exploration, development, and operation that are exposed to a complex mix of market, technical, and execution risks. Understanding how each project and possible divestiture or acquisition candidates affect the overall portfolio risk characteristics and corporate strategy is difficult with conventional static cash flow modelling and scenario analysis

With dynamic cash flow models and Integrated Valuation and Risk Modelling (IVRM), we generate insights into portfolio risk characteristics and the impact of various projects on these characteristics. Our analysis considers different types of risk, such as country risk, and how these risks can be managed through design choices, financing arrangements, and diversification. Risk summaries provide information for corporate risk budgeting and enterprise risk management activities.

We build dynamic cash flow models to help you assess the value and financial risk exposure of: