IVRM Services

Project Evaluation

Mining projects are inherently difficult to analyze, given the design, financing, and operating choices available to a project developer.

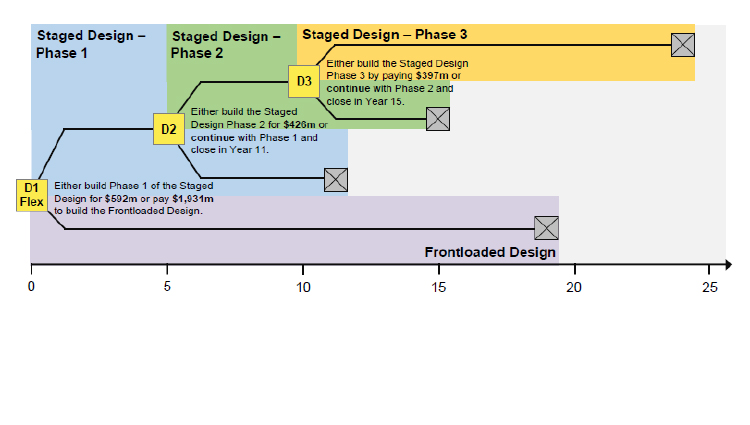

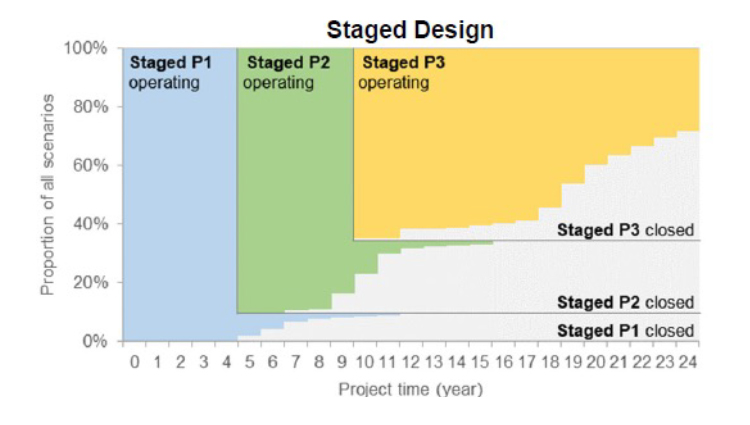

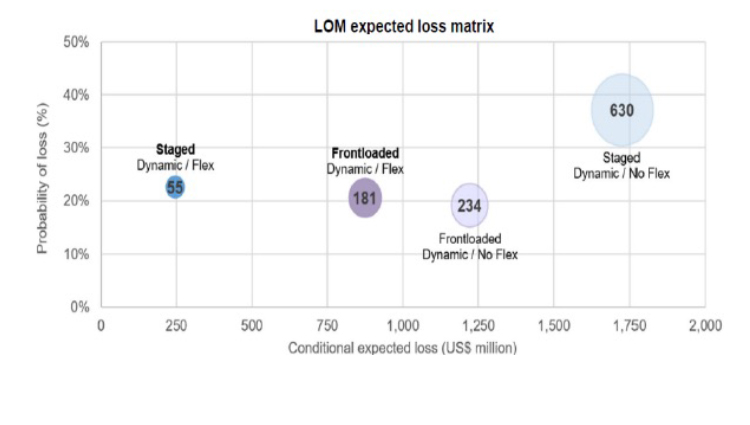

Integrated Valuation and Risk Modelling (IVRM) can show the value and risk trade-offs between competing design and capital investment choices that are simply not apparent with static cash flow analysis. Our analysis considers the possibility of multiple future operating choices, such as investing in an expansion, and the likelihood that a specific choice is made. Additional study provides risk information about expected losses, loss probability, and loss consequence for each design alternative.

We build a dynamic financial risk model to help you assess the value and risk exposure of: