IVRM Services

Project Finance and Risk Analysis

The varied and contingent nature of project finance and taxation can shift value and risk in a manner difficult for static cash flow models to fully anticipate.

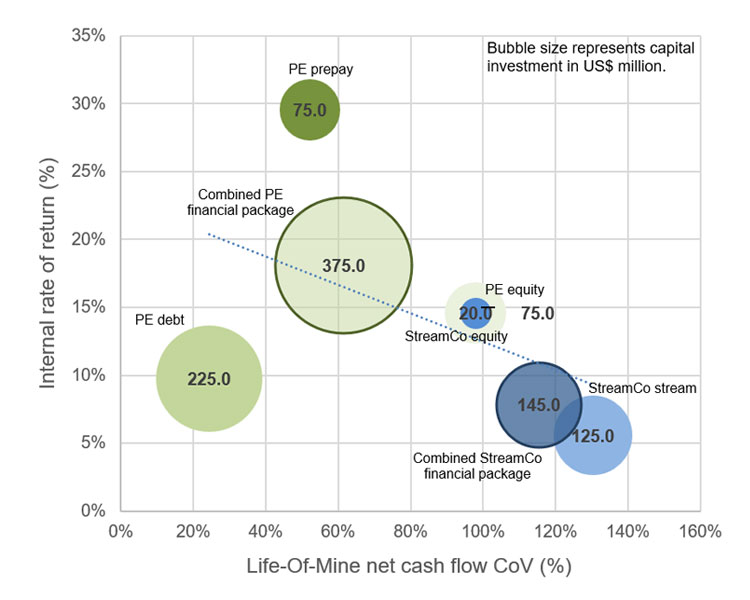

With IVRM, we build a dynamic mining financial risk model to pull apart a multi-layered financing and taxation package to show how cash flow is distributed between stakeholders across a range of future business environments.

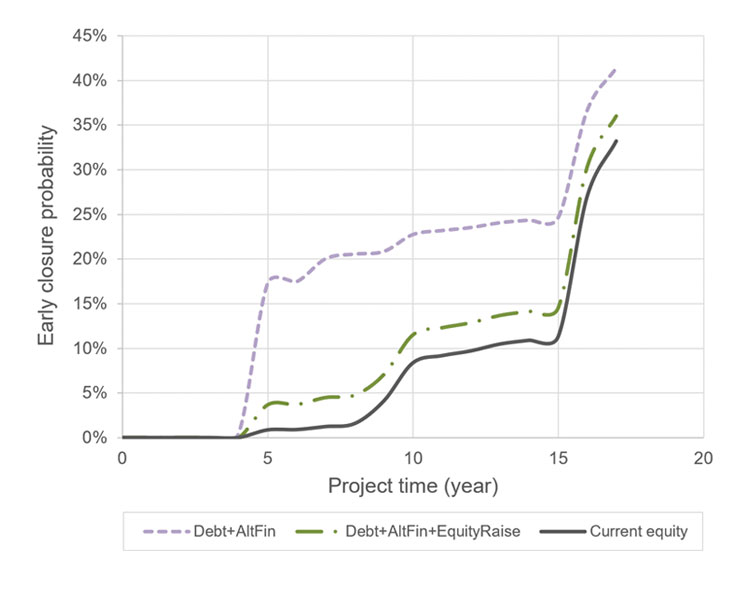

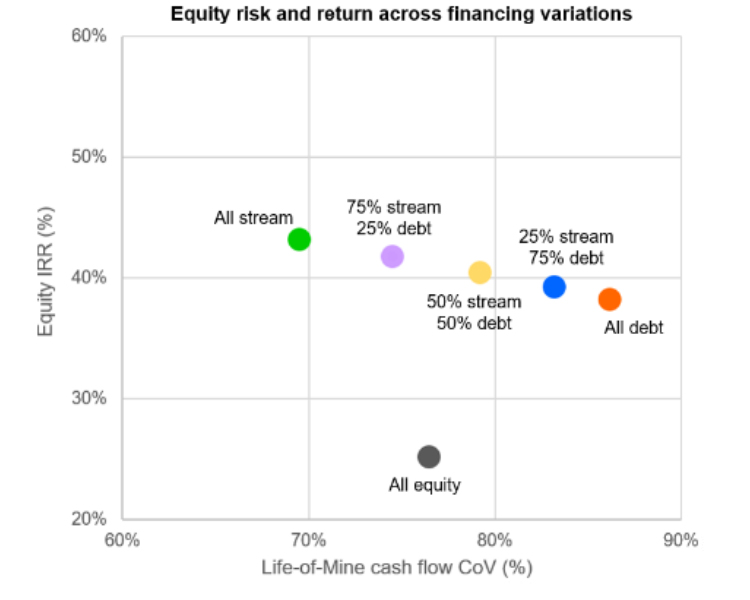

Our analysis provides insight into how different combinations of debt, alternative finance, and equity impacts future operations and the level of cash flow risk. We pair a return calculation with a risk analysis to confirm for our clients that their investment is not over-leveraged and there is a consistent risk-return relationship across financing sources.

We have the skills and experience to help you make sense of: